By E. Sakellari

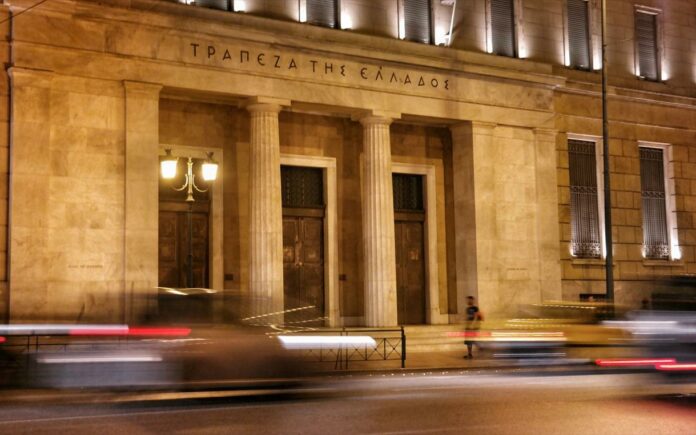

European Parliament elections along with detailed “Eurocratic” procedures have delayed approval of two crucial framework plans, one designed by the Hellenic Financial Stability Fund (HFSF) and the other hatched by the Bank of Greece (BoG), to deal with the Olympus-sized mountain of “bad debt” held by the country’s four systemic banks.

Approval is necessary, among others, by the European Commission’s competition watchdog, the DG Comp.

Nevertheless, the delay has reportedly hampered Greek banks’ next moves, given that regardless of the approval they must meet set targets to reduce non-performing loans (NPLs).

The sluggish pace followed by Brussels’ bureaucrats on the specific issue is linked to the fact that much of the Union’s political leadership will change after the May 26 European election, including the Commission portfolios, in tandem with a reshuffle of the heads of European entities that serve as Greece’s institutional creditors.

The only institution still operating without a letdown is the Single Supervisory Mechanism (SSM), given that its chairman of the supervisory board, Andrea Enria, recently assumed the post.

Among the most closely scrutinized issues by the DG Comp is whether guarantees by the Greek state comprise an indirect state subsidy. As such, estimating the value of such guarantees is also a significant parameter that the DG Comp is examining.