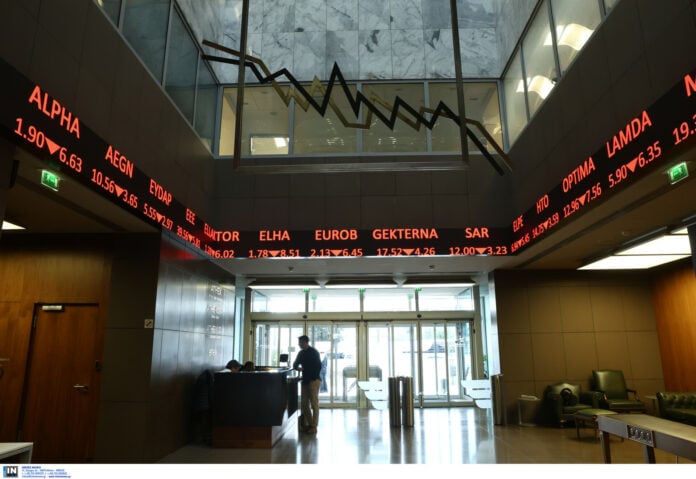

The Athens Stock Exchange has recorded four consecutive negative sessions, having lost a little more than -2.7% of its value.

The ongoing military crisis in the Middle East and the prospect of more active US involvement in the Israel–Iran war are the main reasons for the downward trend of the Greek market and the dampened investor sentiment.

However, Athens—like most international markets—is, for the time being, managing the geopolitical challenges with relative composure, as reflected in both the limited intensity and the controlled scope of the sell-offs.

This is mainly based on the expectation of the investment community that the military conflict will not, on the one hand, bring Russia and China into the “game”, leading to a wider conflict, and on the other hand, there will be no closure of the strategically important Strait of Hormuz by the Tehran regime.

For these reasons, investors see the General Index, although on a downward trajectory, not having lost the critical support of 1,800 or 1,750 points, which constitute the first embankments in the event of a further collapse.

Regarding the agenda of the day, attention is focused on Ideal Holdings, as the 8,000,000 shares, which resulted from the public offering of 48 million euros, are being listed for trading. Today, the General Meeting of Shareholders will also meet, with the aim of approving the proposal for a capital return of 0.3 euros/share.

Eyes on Fed

In addition to geopolitical developments, the markets’ attention is also focused on the Federal Reserve, which is due to announce its decision on interest rates late this afternoon (Greece time). Analysts estimate that Fed chair Jerome Powell will maintain the cost of money at the current levels of 4.25% – 4.5%, not pleasing Donald Trump, who is eager for a reduction.