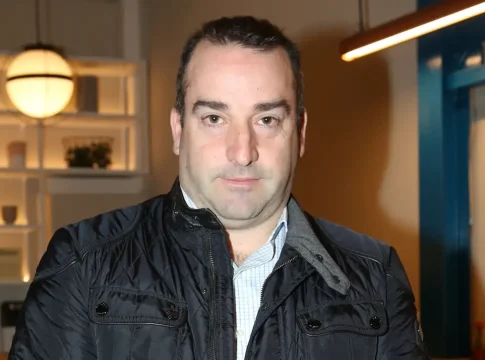

Alpha Bank’s next moves are focused on acquisitions in the field of bancassurance as well as asset and wealth management, the head of Alpha Bank’s Investor Relations department, Iasonas Kepaptsoglou, said in an interview with “N”.

Referring to the cooperation with UniCredit, he stated that it has already borne fruit and multiplied value for the Greek bank.

“The partnership with UniCredit is a strategic choice based on shared values, complementary capabilities and a shared vision for the future of the banking sector in Europe and, of course, in the Southeastern Mediterranean region where we have a presence. The initial approach was made in the context of the search for synergies in Romania, but it soon evolved into something much bigger that strengthens our competitiveness and constitutes Alpha Bank’s comparative advantage over the competition. UniCredit, recognizing the dynamics of the Greek market and the strong position of Alpha Bank, proceeded with a strategic investment, acquiring a total of 26% of the share capital,” Kepaptsoglou said.

Regarding the housing crisis that has been preoccupying the majority of institutional and private bodies in the last year, he clarified that Alpha Bank encourages and actively participates in any initiative that makes possible the utilization of the banking system’s real estate portfolio and the maturation of the institutional framework for social housing.