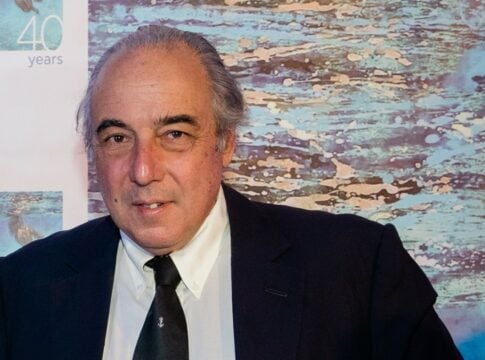

The acquisition of HSBC Malta prompts a strategic shift to CrediaBank’s business plan, with the transaction expected to be completed in the fourth quarter of 2026, according to CrediaBank CEO Eleni Vrettou.

Vrettou also provided more details on the transaction, while noting that the transaction will be capital neutral and will be financed entirely from CrediaBank’s own resources at the time of its completion. The CEO emphasized that the transaction is still expected to receive regulatory approval from the Malta Financial Services Authority (MFSA), the European Central Bank and the Bank of Greece.

Timeline

Giving a clear timeline of the acquisition and the next steps, the CEO of the Greek bank stated that the transaction is currently in the information and consultation process with the Works Council of HSBC Continental Europe in France.

After the completion of the information and consultation process in France, and if HSBC decides to proceed with the transaction, a definitive agreement will be concluded for the sale and purchase of HSBC’s stake in the bank, the CEO said, among other things.

In addition, a cooperation agreement is to be concluded to regulate the respective obligations of the two banks during the period in which regulatory approval will be sought and before the completion of the transaction. In fact, the regulatory approval process is expected to begin immediately after the signing of the definitive agreement.

After completing all regulatory approvals, “we will launch the mandatory public offering to minority shareholders at the current price,” Eleni Vrettou said, adding that the acceptance period for the mandatory public offering is expected to last approximately 3 weeks.

Taking this into account, the transaction is expected to be completed in the fourth quarter of 2026, with the signing and commencement of the transitional services agreement with HSBC by the end of December 2026 at the latest.

However, it was pointed out that the regulatory approval process for the acquisition of HSBC Malta has already begun, with the process requiring the Greek bank to submit a new business plan to the regulators. This is “still in preparation and has not yet been finalized,” the Greek CEO stated, adding that it is expected to be completed before the end of the month.