Robin Energy Ltd. (RBNE), owned by Petros Panagiotidis, is entering a new phase of strategic development, as it announced the launch of a public offering of common shares or pre-funded warrants, with Maxim Group LLC taking on the role of exclusive bookrunner for the transaction.

As the company pointed out, all proceeds will be directed to working capital and general corporate purposes, strengthening its liquidity in a period of intense mobility in the international shipping and energy markets. At the same time, the completion of the process remains conditional, as it depends on market conditions.

The public offering follows the completion of Robin Energy’s first digital asset placement. The Nasdaq-listed shipping company confirmed the completion of a 5 million Bitcoin allocation through Anchorage Digital Bank N.A., as part of its new strategic framework.

Panagiotidis, chairman and CEO of the listed company, said the move reflects the company’s belief in Bitcoin as a “rare digital asset with long-term value” that can complement Robin Energy’s strategic development and create additional value for shareholders.

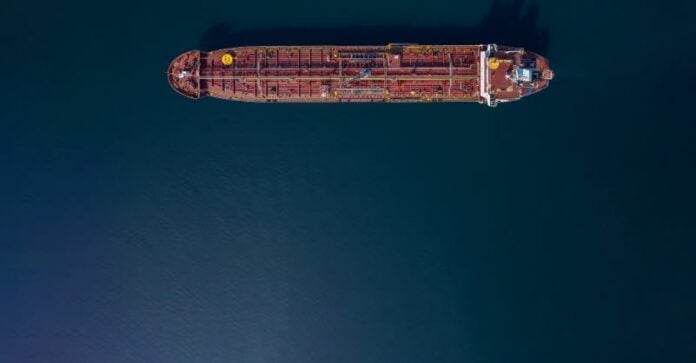

With a fleet that includes a Handysize tanker and an LPG carrier, Robin Energy seeks to combine its traditional energy transportation business with a more innovative and diversified approach to capital management. The almost simultaneous announcement of the Bitcoin investment and the public offering shows its intention to move dynamically in both the capital markets and the digital investment sector.