Greek banking institutions are emerging as the main financial supporters of Greek shipping with nine banks accounting for 35% of its funding.

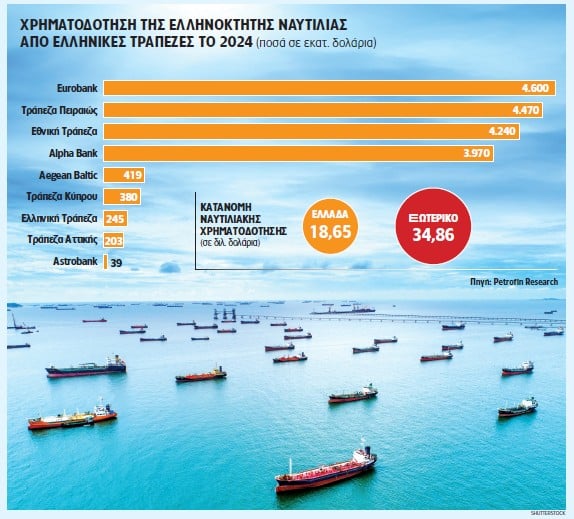

According to the annual report of Petrofin Research, the total portfolio of Greek banks in Greek-owned shipping reached 18.65 billion dollars at the end of 2024, while the total financing stood at 53.51 billion dollars.

Both Greek banks and total financing moved upwards. In total they recorded an increase of 5% compared to 2023. The most impressive issue, however, is that Greek banks achieved the largest increase, by 17.5%, compared to 2023. Specifically, it stood at 15.79 billion dollars in 2023 and 14.07 billion dollars in 2022.

The four systemic banks

Indeed, the four systemic Greek banks have consistently been in the top five positions in financing Greek shipping in recent years, behind UBS.

Specifically, Eurobank is in second place with a portfolio of 4.6 billion dollars. It is followed by Piraeus Bank with 4.47 billion and National Bank with 4.24 billion. The golden four is closed by Alpha Bank, whose portfolio reaches 4 billion (3.97 billion).

Aegean Baltic, the fifth Greek bank, has a portfolio of 419 million, while Bank of Cyprus is estimated at 380 million. Hellenic Bank follows with 245 million and Attica Bank with 203 million. Finally, Astrobank stands at 39 million dollars.

Another feature that stands out in this year’s list of banks that finance Greek shipping is Chinese leasing.

China Merchants Bank Leasing reached 3 billion dollars in 2024, recording an increase compared to 2023 by 50%, and ranked seventh, behind the City whose portfolio is 3.3 billion dollars.

2024 was a successful year for Greek shipping financing, which increased by 5% year-on-year.

Despite the generally uncertain environment on all fronts, Petrofin notes, banks continue to maintain their lending capacity, focusing on the clientele that needs financing for the construction of new ships.