Investors have put behind the painful experience of the last year after the outbreak of the war in Ukraine, the energy crisis and the inflation explosion and are faced with new challenges: high stock returns and new investment products affected by the increase in interest rates amidst positive economic expectations and political stability.

The Athens Stock Exchange is moving upwards after 15 years of devaluation and accumulation of losses, boosting domestic portfolios and restoring investors confidence.

Naftemporiki outlines possible options that investors have in the Greek capital market andthe banking/insurance system.

First of all, what is happening today in the stock exchange is inextricably linked with the first place that Athens “climbed” this year.

Investors in the Athens Stock Exchange have many options to place their funds based on the fundamentals of the listed companies as well as the perspectives of specific sectors. For example, there are 19 listed companies with a capitalization of more than 1 billion euros followed by 35 mid-cap companies with an average value of 200 to 600 million euros and are good investment options.

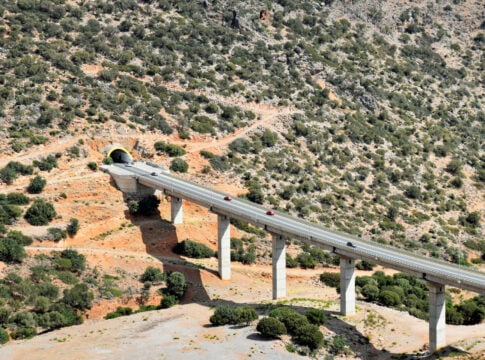

The ‘hot’ sectors of the Athens Stock Exchange are energy, construction, oil refining, travel, transportation and logistics. Also, the majority of mutual funds offered high returns and profits to the shareholders in the first five months of the year. As for deposit products, interest rates are close to 1.80% for amounts from 100,000 and one cent while they can exceed 2% and reach up to 4% under specific conditions.