A resumption of a previously unproductive tax on “surplus profit” from the sale of all types of real estate in still bailout-dependent Greece will again come online in 2018. The tax on the amount between the purchase and sale price, if such arises, returns on Jan. 1, 2018 and will affect a dramatically slumped property market in Greece, sans very few exceptions in well-known holiday destinations.

The soon-to-be returned “surplus profit” tax is calculated at 15 percent on the amount arising from the initially purchase and subsequent sale, with the levy to be paid by the seller. The buyer must still pay a 3-percent transfer levy tacked on to the objective tax value of the property, as assessed by the state.

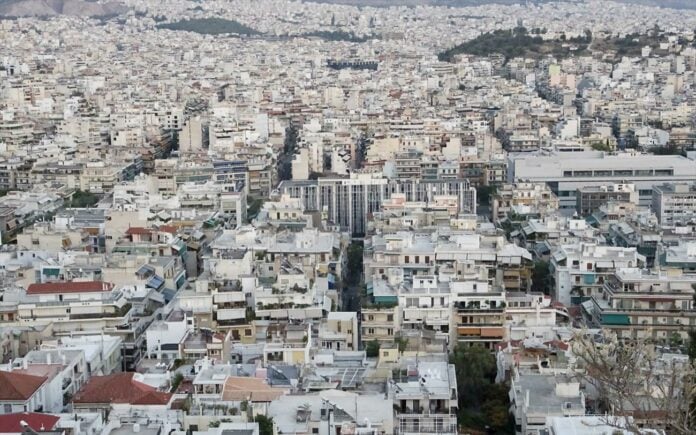

A punishing and ongoing economic crisis has long burst the “property” bubble in Greece, particularly in urban areas, with the vast majority of transactions over previous years listed below the original purchase price by the seller.

In a bid to avoid charges towards third parties (notaries, land deed registration etc) as well as tax on the transaction price, buyers and sellers over previous decades also liberally employed “under-the-table” cash payments, thereby only the objective tax criteria – which was always less than the commercial value – was used to impose taxes and fees on a transaction.