By George Teriakidis

Mr. George Teriakidis is the Regional Business Development Manager of South East Europe, Middle East & Africa at DNV GL – Maritime

Broadly speaking, ships will evolve naturally in line with economic trends and advancing technologies. Futuristic designs of passenger ships and navy vessels often influence public opinion about future ships, exotic hull forms and materials. However, the world’s fleet is and will continue still mean mainly dry bulk, liquid bulk and general cargo.

Our recently published Maritime Forecast to 2050, outlines some of the trends we have identified as likely to shape the industry heading to 2030 and beyond. We forecast that trade measured as tonne-miles will experience 2.2% annual growth over the period 2015-2030. In terms of energy commodities, our model predicts that global seaborne trade in crude oil and oil products, will reach peak volumes before 2030, while natural gas -as liquefied natural gas (LNG) and liquid petroleum gas (LPG) – will experience sustained growth, as gas takes over as the largest energy source.

In terms of individual ship sectors, containers will experience the strongest growth of all segments driven by strong demand for consumer goods and continued containerization, alongside gas carriers where demand increases from areas with less domestic gas and new sources of unconventional gas not connectable by pipelines. Bulk transport will continue to grow, driven by strong increases in grain, moderate rises in ore and other minor bulk. And overall, shipping growth is likely to be focused in Asia and the Indian Ocean regions, which continues recent trends.

The long-term economic and ecological pressure for energy efficiency will inevitably lead to lower ship speeds. At the same time, smarter design processes will look at power requirements in realistic operational scenarios, i.e. variations of operational conditions (speed, load) and ambient conditions (sea state) to minimize yearly fuel consumption.

With lower ship speeds, ships could become wider and shorter. Bulbous bows will shrink and in some cases disappear leading to straight-stem bows. Propulsion improving devices will proliferate. Lower speeds could also mean that air lubrication technology and wind-assisted propulsion are increasingly considered for new designs.

A broader trend towards cleaner fuels combined with lower speeds will affect maritime propulsion profoundly. A mix of low-sulphur, low-carbon fuels with LNG in the lead could replace heavy fuel oil. While today’s diesel gen-sets may be replaced or enhanced through the addition of fuel cells and batteries. And this shift to cleaner fuel and lower-maintenance machinery will reduce crew workload.

Materials

Ship hulls will continue to be made of steel, simply because it is cheap, strong and easy to recycle and better coatings and inspection programs will improve protection against corrosion. Intelligent condition monitoring schemes will provide the appropriate technologies to extend the average life-span of steel structures:

- Embedded monitoring systems and conventional surveying schemes will generate Big Data for ships in service. Cross-referencing this data will support intelligent condition monitoring systems.

- Image processing techniques will be used to automatically detect corrosion and cracks.

- Artificial Intelligence will predict more accurately location, extent and type of cor-rosion.

- Digital twin technology will allow assessing the as-is condition at any time.

Composites will be used increasingly, but for selective application such as high-speed craft, super-structures of passenger ships and in equipment and outfitting. And antifouling paint will see a shift towards more sustainable technologies, for example nano-coatings with microscopic surface structures, frequent robotic grooming or ultra-sonic protection schemes.

Operation

The current wave of digitalization transforming our industry will also have a profound impact – advancing design and operation and creating new business models. Falling costs for sensors, computing power and satellite communications make it a safe prediction that ships of the future will be “smart”, i.e. equipped with various embedded sensors and data processing.

General developments in ICT (information and communications technologies) will have a profound effect on the shipping industry. Of course, ICT allows us to perform traditional tasks better (faster, cheaper, or more accurately), but perhaps even more importantly, ICT opens the door for us to consider completely new options. We will witness “more” of the same trends as in the past decades: an increase in the exchange of data and more collaboration between stakeholders.

Various developments will make ships easier to operate. Examples are condition-based maintenance systems (diagnosing eventual problems at an early stage and supporting the fixing of the problem, for example, by ordering spare parts, preparing 3D printing or guiding repair by ordinary persons without expert knowledge on the system, using Aug-mented Reality for intuitive guidance). Along with reduced workload in the engine room due to cleaner fuels, this will allow further reductions in minimum crew sizes.

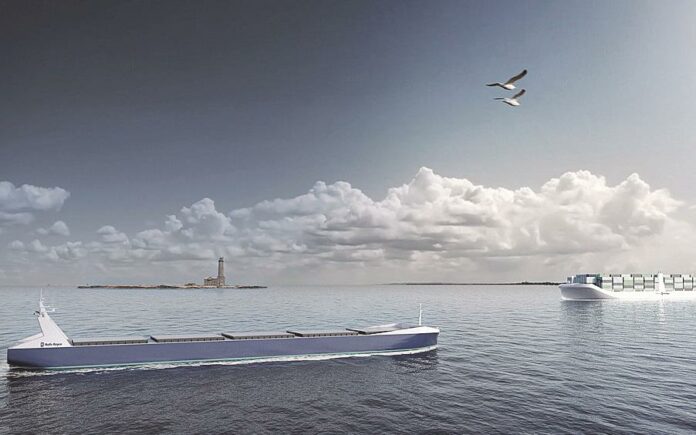

We may also see the emergence of low-crew smart ships (with automatic collision avoid-ance; automatic berthing; self-monitoring for hull, engine and cargo; the ability of some vessels to sail autonomously for a limited time in certain conditions, etc.) and even no-crew drones for specific applications (for example, short-distance ferries, tugs and fire-boats).

At the end of the day, however, these changes may alter the shape of our industry, but not its overall importance to trade and the global economy.