Six foreign investment funds have up until now submitted applications with the Bank of Greece (BoG) to receive licenses for managing non-performing bank loans (NPLs) in the country.

The information was announced on Tuesday by a top BoG official, who wished to remain unnamed.

NPLs in the country now exceed a whopping 110 billion euros, constituting one of the biggest problems facing the still “capital controlled” Greek banking system.

The same official also said necessary legislative changes are now imperative in the country in order to allow for the suspension of “non-cooperative” shareholders in companies facing bank-sponsored restructuring, as well as to provide legal protection for banking executives assigned roles in corporate restructuring. The latter reforms will ostensibly mirror legal provisions that exist in more advanced bankruptcy and banking codes in other European countries.

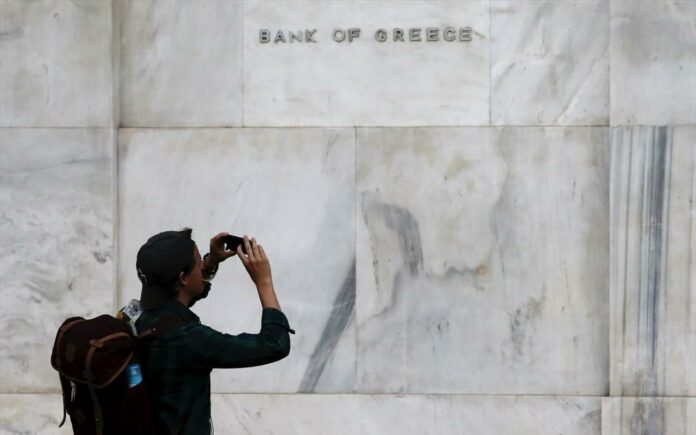

BoG Gov. Yannis Stournaras himself commented on the issues, during a meeting with creditors’ representatives at this office in the central bank’s downtown Athens offices.

Representatives of Greece’s institutional creditors, now known as the “quartet”, earlier met with Hellenic Financial Stability Fund chairman George Michelis.